Fund Details at a Glance

Offering: Private Non-Traded REIT (Real Estate Investment Trust)

Minimum Investment: $1000

Availability: All US Residents (Accredited)

Fund Investment Strategy

The fund strategy for the Growth REIT is a value-add investment strategy designed to accelerate growth over a 7-year cycle.

Investment target details

- Type: Office, retail, and multifamily real estate (apartment buildings only)

- Size: 100+ units

- Markets: across the US

- IRR: targeting between 10% and 20% return rate for each property

- The value-add cycle is approximately 5-7 years.

5 Stages of the Value-Add Cycle

-

01

Capital Raise

The fund opens to begin collecting capital to purchase properties.

-

02

Acquisition

Properties are acquired that meet the strict criteria of our real estate experts and that offer strong potential for increased value at the time of resale.

-

03

Renovation.

As part of our value-add investing strategy, existing cash-flowing properties are acquired and then renovated to allow for increased rents and property value appreciation.

-

04

Appreciation.

Once the renovations are complete, we allow time for the properties to increase in value.

-

05

Disposition.

Properties are sold and any profits are distributed to investors.

Diversify With One Investment

REITs are designed to allow investors to spread an investment across multiple properties, creating higher levels of diversification.

Historically, REITs have provided investors of all types with regular income streams, diversification of their portfolio, and long-term capital appreciation opportunities.

Retirement Funds & REITS

A simple way to invest in commercial real estate is through a Real Estate Investment Trust (REIT). REITs are a diversified basket of commercial real estate and can have the objective of appreciation and cash-flow, without any of the responsibilities for the day-to-day management of the properties.

RAM REIT I allows investors to use retirement funds from their Self-Directed IRAs (SDIRAs) to purchase shares in public, non-traded REITs. By allocating to real estate, investors may diversify their portfolios and generate income that can grow and compound within a tax-sheltered IRA over time.

REITS: A Retirement Investment Tool

REITs are known for their objective of regular passive income, because they are required to distribute at least 90% of their annual taxable income to investors on a yearly basis in the form of dividends. Another essential characteristic of commercial real estate is the potential to protect against inflation. This benefit arises because property values and rents have historically been positively correlated with growth in inflation.

-

Diversification

Real estate has a low (or negative) correlation to other asset classes, which means REITs may shield IRAs from market volatility.

-

Passive Income

Our REITs are designed to generate monthly or quarterly distributions, which investors may elect to automatically reinvest.

-

Long-term Growth

Over time, real estate has the potential to grow in value and may even outpace inflation.

Fees & Expenses

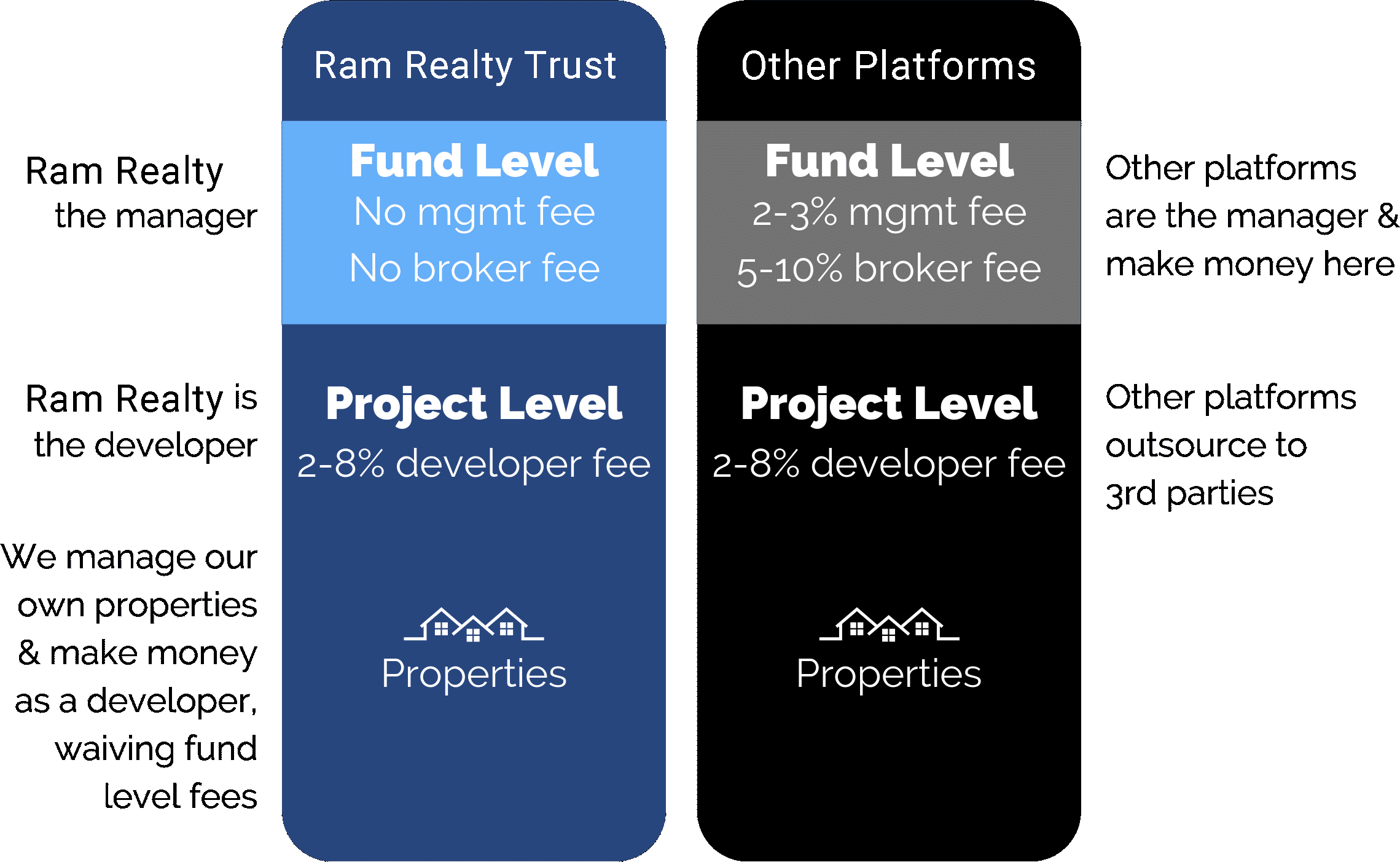

Ram Realty Trust is eliminating middleman fees because we do everything in-house. At the REIT level, we do not charge any platform level or management fees. We are able to limit our fees to just a project level acquisition/development fee because we are the real estate sponsor on all of the deals that the REIT invests in (the sponsor is the entity responsible for finding, acquiring, managing and selling assets in a real estate deal).

Frequently Asked Questions About Retirement Investing

-

How Do I Get Started?

Begin the process to set up an SDIRA account by clicking “Invest” on the RAM REIT I page. You will be prompted to select the form of ownership for your investment. Select “Retirement,” then choose to either open a new SDIRA with our preferred custodian, IRA Services Trust, or use an existing SDIRA.

-

Can I Automatically Reinvest My Distributions?

Yes. If you elect to participate in our distribution reinvestment plan, any distributions may be automatically reinvested, allowing you the potential to realize a compounded return.

-

Will The Distributions I Receive Be Taxable As Ordinary Income?

REIT distributions may be treated as ordinary income, capital gains, and/or return of capital for tax purposes, each of which may be taxed at a different rate for different investors. As each investor’s tax considerations are different, it is recommended that you consult with your tax advisor. You also should review the section of the offering circular entitled “U.S. Federal Income Tax Considerations,” including for a discussion of the special rules applicable to distributions in repurchase of shares and liquidating distributions.

-

Can I Invest In RAM REIT Reit Offerings Using A SDIRA (Self-directed Ira) Or Other Type Of Retirement Account?

Yes. We may accept retirement funds into our REIT offerings. This means you can use your Self-Directed IRA (“SDIRA”) to make investments. The minimum initial investment in a REIT offering using a retirement account is $5,000. Subsequent investments may be made at a minimum of $1,000.

-

What Is A Self-directed Individual Retirement Account (SDIRA)?

A self-directed Individual Retirement Account is a retirement account that provides investors with certain tax benefits for retirement savings. Self-Directed IRAs are held by a trustee or custodian that permits investment in a broader set of assets than is permitted by most IRA custodians, such as real estate, promissory notes, tax lien certificates, and private placement securities.

-

How Can I Fund My Individual Retirement Account Prior To Making My Investment In A RAM REIT I offering?

You can fund your IRA account in three different ways:

1. Transfer retirement funds from your current custodian

2. Rollover funds from a 401(k) or another qualified plan

3. Make a cash contribution within the annual limits defined by the IRS

-

What Types Of Accounts Are Eligible For Transfer Into A Self-directed Ira?

You can transfer funds from a 401(k), 403(b), 457 or other qualified retirement plans into a self-directed IRA.

-

What Is A Custodian, And Which Custodians May I Use?

A custodian is defined as a bank, federally insured credit union, savings and loan association, or an entity approved by the IRS to act as a trustee or custodian. Ram Realty Trust works with a variety of custodians, including our preferred custodian, IRA Services Trust Company.

-

Can Ram Realty Trust Support Required Minimum Distributions?

A custodian is defined as a bank, federally insured credit union, savings and loan association, or an entity approved by the IRS to act as a trustee or custodian. Ram Realty Trust works with a variety of custodians, including our preferred custodian, IRA Services Trust Company.

Ready To Make Your Money Work For You?

Invest into one of our REITs to gain access to Auto Invest and watch your investments grow month-after-month for you automatically. If you have any questions, feel free to contact a member of our Investor Relations team at (980) DIAL-RAM or email info@ramrealtytrust.com